Why You Shouldn’t Listen To Tax TikTok

November 15, 2023

Taxes can suck. I think I speak for a lot of people when I say I hate seeing my hard earned money being taken from me and given to the government. (Let me preface this and say I do love the new roads, public education, and some incredible things that our taxes do pay for). But does uncle Sam really need 22% or more?!

On the flip side of the coin, it seems like everyone’s goal is to pay as little taxes as possible. That is a great goal, and I’m totally on your team.

Likely, you’re under the impression that there’s some secret tax strategy that you can implement and make all of your taxes go away, while riding away into the sunset with a brand new G-Wagon that was practically free. Unfortunately, I am here to burst everyone’s bubble and say there is no secret to this that we are all missing.

Yes, if you are Warren Buffet and have millions of dollars invested in real estate, stocks, bonds, other businesses, and also a team of about 30 lawyers and accountants, you can get really creative with your tax structure and business losses and write offs and loopholes and pay less tax.

For the majority of us, taxes mean that we are making money! And that your business is MAKING MONEY. That you are working hard and you are on the path of success.

I am here to encourage your tax strategy as an individual, a side hustle or a small business. And let you know that there’s no secret sauce. It’s just about staying organized, and taking advantage of the legal write offs you’re already eligible for.

So here are the most frequent questions and misconceptions I hear around tax time.

How do I know if I am getting all of my deductions?

Truth be told, as an individual tax filer, you are most likely going to be taking the standard deduction ($25,900 for joint filers, $19,400 for heads of household, and $12,950 for single filers and those married filing separately). The only way you would take the itemized deduction is if you have a yearly expense of mortgage interest, charitable contributions, qualified medical expenses, DMV Fees, etc. that exceed your standard deduction. This is increasingly rare.

For small businesses and side hustles (aka Schedule C filers) this is where you want to keep track of all of your business related expenses throughout the year. All of the small things you paid for (think parking fees, printer ink, app subscriptions) throughout the year will lower your net income and in turn lower your tax liability.

Can’t I become an S-Corp and save a bunch of money?

Short answer No. You can go back and read our previous blog all about S-Corps, but this election wont help you until you are making $75k-$100k.

For the side hustlers, you are going to be filing a Schedule C which 100% flows to your individual tax return. You can lower the income you make here by keeping track of all your business deductions throughout the year. If you feel you want to take the next step/feel more protected you can register to become an LLC. An LLC is strictly a legal move. As a single member LLC, your earnings will still flow through 100% to your personal return.

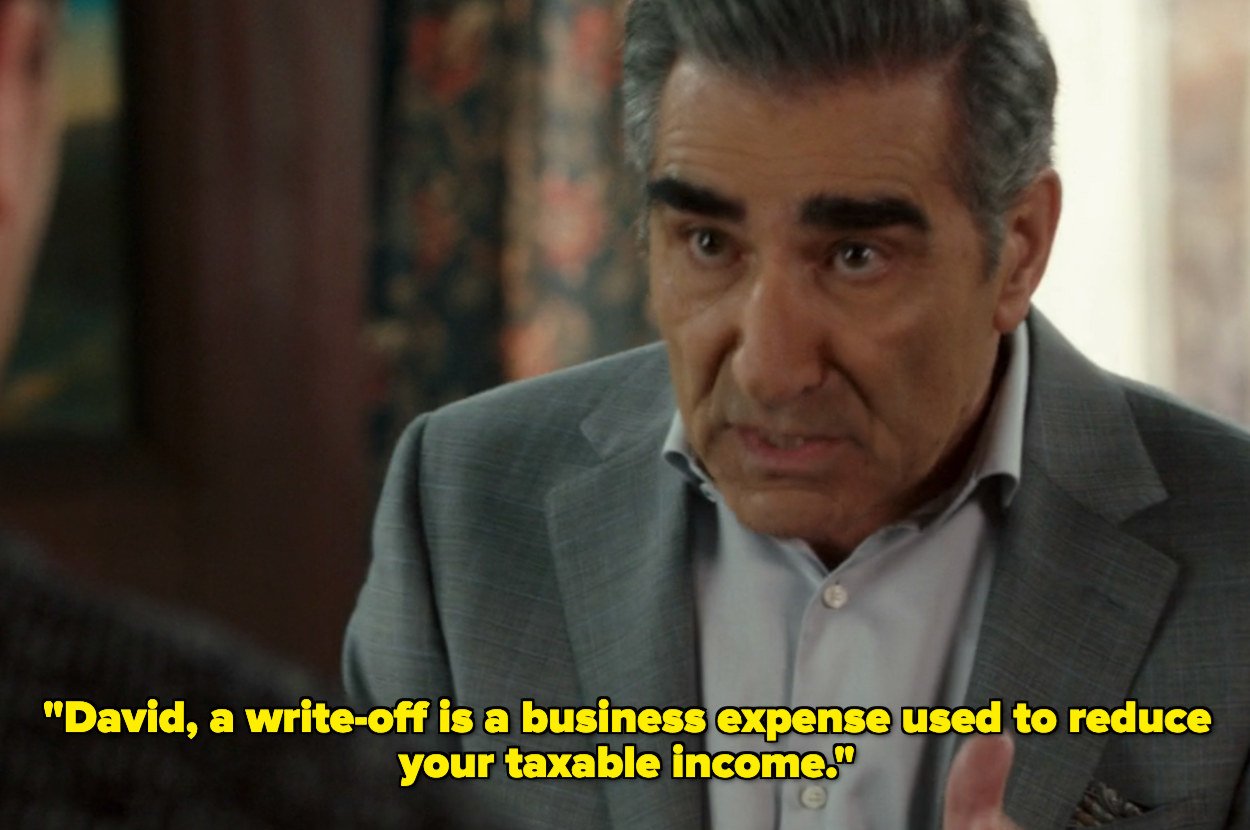

Okay but what about my car and computer, can’t I just write these things off?

For some reason a lot of Reels and TikToks want you to think there are magic hacks. Again I am here to burst your bubble.

You can keep track of your mileage with apps or by keeping a log on a spreadsheet. However, mileage does not include your daily commutes to an office or co-working space.

If you have to drive 45 miles to a professional networking event, that counts as a mileage deduction. And– the deduction is over $0.50 per mile you drive. That can add up – but again it requires being organized!

I am not even going to touch on this “buy a G Wagon because it weighs 4,000 lbs and its a tax write off”. Please don’t buy a G Wagon for the ‘tax write off’.

My advice is to not buy anything unless you actually need it. Because if it’s not a good economic decision for you, it’s not a good tax decision. Period.

Buying a $2,000 computer, yes will lower your overall net income, but it is not a dollar for dollar tax savings. If you have a large expense and are planning to buy something in January, yeah you can probably bump that purchase up to December to save you a small percentage of tax liability.

I don’t want to go to prison or get in trouble with the IRS!

If you are honest with your reporting, you will not get in trouble with the IRS. You will only get hit with a penalty if you did something wrong, so you can scrap your jail time fears. The simplest ways to ease your IRS stress is by keeping receipts of expenses, reporting all of your income especially if you received a 1099 for it, making quarterly tax payments if you are solely a 1099 contractor, and filing things on time.

A couple dollars goes a long way. Ask for help, seek professional advice. If a 30 minute call with an accountant can save you a couple of dollars and a few hours of restless sleep, isn’t that worth it? *as I side eye my $5 half drank coffee next to me* Even the TikTokers say it at the end of every video “ask your financial professional” because we are here to help you and we LOVE helping you.

Leave a Reply Cancel reply

About Gradient Accounting

Gradient Accounting is a firm built with modern small businesses in mind. Our mission is to help you get your finances under control so you have time to travel, enjoy your life, and pursue your passions. Our team has more than 33 years of cumulative accounting, tax, and consulting experience. Our blog reflects our unique take on the latest news you need to know in the small business world. We are also passionate about providing free resources here to help you scale your business and earn more money in the process.